About E-Pawn | Trusted Car Pawn Shop in Parramatta

E-Pawn: Sydney’s Best Place to Pawn a Car or Motorcycle for Instant Cash!

We also pawn other high-value items like Jet Skis & ATVs

• Shop 6c/3 Victoria Rd, Parramatta •

Find us on Google Maps📍

✔️ Cash Loans to $50,000

✔️ No credit checks

✔️ No Application Fees

✔️ 1 to 90 Day Loans

We Pawn all Quality Cars

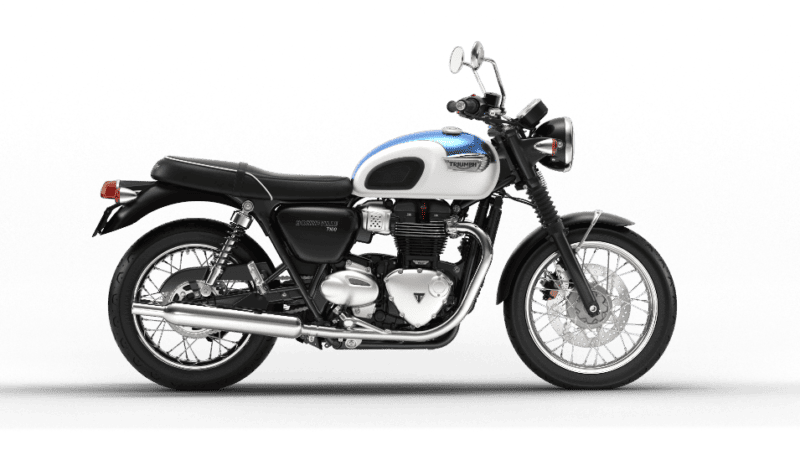

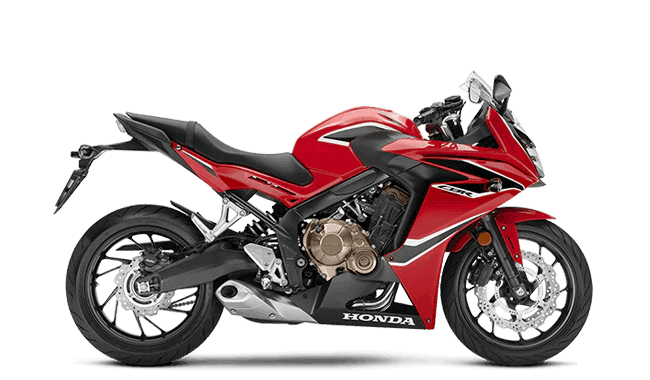

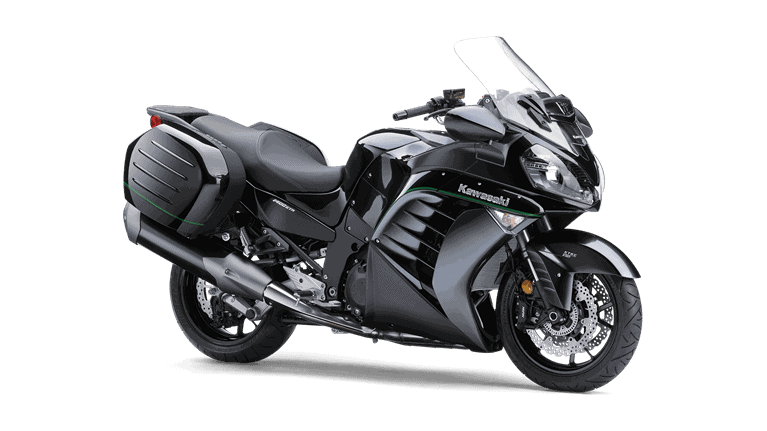

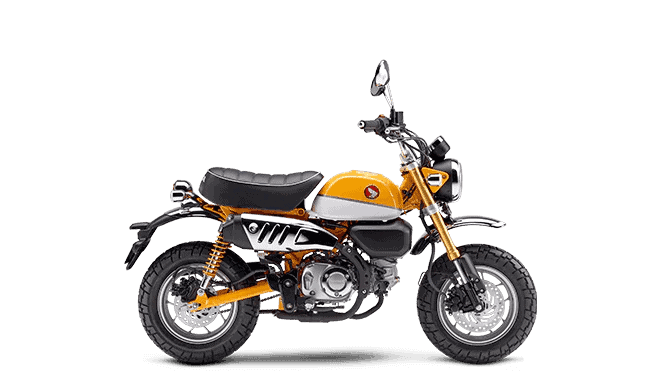

We Pawn most Motorcycles

Want to know more about our Pawn Loans – Call us today!

Or use our Online Enquiry Form and we’ll call you

Or ‘Text’ pics of your car or motorcycle for a free loan-value appraisal. Click here to see how >>

Fastest Cash Loans in Sydney – Pawn a Car or Motorcycle Today with E-Pawn

1 Hour – That’s all it takes!

Our pawn shop for cars and motorcycles offers 1-hour cash loans ranging from $2,000 to $50,000 – possibly more, just ask! Enjoy same-day cash settlement on all loans.

Borrow money for any purpose: from car repairs and essential bills to medical treatment and supporting loved ones. It’s fast, easy, and convenient.

Get a free no obligation quote >>

If you’re looking to pawn a car or motorcycle to raise cash quickly, come to E-Pawn. Our experienced team offers competitive rates and same-day loans to meet your needs.

Looking for a pawn shop in Parramatta with our famous 1-hour service? Find us at Shop 6c, No.3 Victoria Road, Parramatta, NSW, 2150. Check us out on Google Maps 📍

Fastest Cash in the West !! $$

E-Pawn is one of Sydney’s leading auto pawn shops, specialising in fast and easy cash loans secured against your car, motorcycle, Jetski, or ATV. We offer competitive rates and reasonably flexible loan terms to suit most customers’ needs, ensuring a straightforward and convenient process for quick cash when you need it most.

If you’re looking to pawn a car or borrow cash quickly, you’ve come to the best car pawn shop in Sydney. Our car pawnbroker and money lending service offers the fastest way to secure a short-term cash loan. Whether you have good or bad credit, our secured title loans against your car or motorcycle eliminate the need for credit checks.

Whatever the type, make, or model, we aim to pawn cars and motorcycles quickly — usually within the hour. E-Pawn Pawnbrokers is proud to be Sydney’s trusted pawn shop for cars and motorcycles.

Conveniently located in Parramatta, we’re here to provide hassle-free loans when you need them most.

Money Lent Instantly

Want to know more about our Car Pawn loans … Give us a call today!

Or use on our quick application form below and we’ll contact you with a quote

Quick Application Form

Frequently Asked Questions

Pawn a Car ++ Pawn a Motorcycle ++

Question: Why is pawning a car for cash the easiest way to get a fast cash loan?

Answer: When you pawn a car for cash is the easiest way to get a fast cash loan because it requires minimal paperwork and no credit checks. Unlike traditional bank loans, which involve lengthy approval processes, pawnshops offer immediate cash in exchange for your car as collateral. As long as you own a car and can provide proper identification, you can quickly access the funds you need without the hassle of extensive background checks or credit evaluations. However, it’s essential to consider the risks involved, as failure to repay the loan may result in the loss of your car.

Learn more about how to hock a car >>

What is a pawn car title loan?

Answer: It’s a fast, collateral-secured loan using your car title—ideal if you want quick cash with no credit checks.

Are you a licensed pawnbroker?

Answer: Yes. E-Pawn is a licensed pawnbroker in New South Wales under the Pawnbrokers and Second-Hand Dealers Act 1996 (Licence #2PS26801) and regulated by NSW Fair Trading. We follow strict compliance standards so every loan is transparent, fair, and fully legal — protecting your rights and ensuring complete peace of mind..

If I pawn a car, how much can I get?

Answer: Pawning a car is determined by its base or wholesale value rather than its full retail value. On average, car pawnbrokers like E-Pawn can offer loans equivalent to about 50% of your car’s wholesale value. For instance, if your car’s wholesale value is $20,000, you could borrow up to $10,000 or more, depending on the car’s condition and your circumstances.

Specialist auto pawn services, such as E-Pawn, typically loan higher amounts than general pawn shops because we have a deeper understanding of vehicle values. Loans range from $2,000 to $50,000, with exceptions for higher-value vehicles. When it comes to pawning your car or motorcycle, E-Pawn is widely regarded as Sydney’s leading car pawn shop.

Does a bad credit rating matter when pawning a car?

No, your credit rating doesn’t matter when you pawn a car with us. Many people worry about this, but as licensed car pawnbrokers, we provide loans based on the value of your car, which acts as collateral. Learn more about our no credit check loans>

Even if you’re unemployed, on a bridging visa, or receiving Centrelink benefits, you can still pawn your car. We also accept cars with club registration, limited registration, or those undergoing restoration.

Pawning your car offers a quick cash loan solution when time is critical. For business purposes, the interest on an auto pawn loan might even be tax deductible.

Note: E-Pawn is not a payday lender.

Can I pawn a car and still drive it?

Australian regulations require that items pawned with licensed pawnbrokers remain in their possession until the loan and interest are fully repaid. When you pawn your car with E-Pawn, we securely store it until you’ve redeemed your pawn loan.

Which is better, pawn or sell my car?

It depends on your situation. If you expect to repay the loan on time, pawning your car can provide short-term financial flexibility. However, if repayment seems unlikely, selling your car might be a better option.

Is it necessary for me to sign over my car?

Not automatically. When you pawn a car with us, the Pawn Ticket agreement outlines terms and conditions, including what happens if you default:

Default: If you don’t redeem the pawned car by the due date, E-Pawn may sell the car to recover the loan amount, interest, and any costs associated with the sale.

Are all pawn shops willing to pawn a car?

No, not all pawn shops are equipped for auto pawn services. Pawning your car requires secure storage and specialised handling. E-Pawn is one of the few Sydney pawn shops capable of securely storing vehicles and providing expert car pawnbroker services..

“Hock a Car” means what?

Hocking a car is the same as pawning a car. The terms are interchangeable, although “hock” is more commonly used in Europe. The terms “pawn” and “hock” are thus synonymous.

Do you only pawn cars in Sydney?

No, we pawn cars from all over Australia. However, the vehicle must generally be brought to our licensed premises in Parramatta, NSW, where E-Pawn operates.

However, in some cases—such as when the car is particularly valuable, temporarily undrivable, or where the owner is incapacitated—we can arrange to have the car securely transported to our premises. Contact us to discuss your specific situation, and we’ll do our best to accommodate your needs.

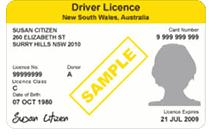

If you want to pawn your car, you will need an acceptable form of identification:

- We will need to sight your Australian Drivers’ Licence

– your name address must match the car’s registered details; - In some circumstances we will accept a NSW Photo ID Card showing:

– Your name;

– Your address;

– Your date of birth; and

– Your signature.

We also need proof of your ownership of the car: i.e.,

- The car’s Registration papers (if applicable); or

- Sales Invoice (in some circumstances); or

- Other acceptable proof of purchase to prove your ownership.

Question: Is it better to pawn my motorcycle for a fast cash loan than to sell it?

Answer: The decision to pawn a your motorcycle for a fast cash loan, or sell it, depends on your specific financial needs and priorities. Pawning your motorcycle allows you to retain ownership while accessing immediate cash, using the bike as collateral. This option is ideal if you plan to repay the loan and retrieve your motorcycle. However, if you are uncertain about your ability to repay the loan or no longer need the motorcycle, selling it outright may be a better choice. Selling the motorcycle provides a lump sum of cash without the obligation of repayment. Consider your financial circumstances and long-term plans to determine which option aligns better with your needs.

Learn more about how to hock a motorcycle >>

Question: Are pawn shop loans faster than traditional finance?

Answer: Pawn shop loans differ from traditional finance companies in their accessibility and speed. Unlike traditional lenders that often require extensive credit checks and documentation, pawn shops, such as E-Pawn, provide quick cash based on the collateral value of items like cars and motorcycles without the need for credit history. This makes pawn shop loans secured against cars and motorcycles more accessible to individuals with varying credit backgrounds. Additionally, the approval process is expedited, enabling borrowers to receive cash swiftly. While traditional finance companies may offer larger loan amounts, pawn shop loans offer a more streamlined, flexible, and accessible solution for those in need of immediate financial assistance without the bureaucratic hurdles often associated with conventional lending institutions. This why our Pawn shop for Cars is a better option when you need cash fast.

Learn more about other things we pawn >>

Can I Get a Discount if I Repay My Car Pawn Loan Early?

Answer: Yes, we offer a discount for early repayment of your car pawn loan! If you repay (redeem) your loan within the first 10 days of pawning your vehicle, you’ll receive a 10% discount on the interest owed. It’s our way of rewarding borrowers who settle their loans quickly. Keep in mind, interest is calculated at a flat rate for the first month, then transitions to a daily rate for the remainder of the loan term. This term typically lasts up to a maximum of 90 days. Paying off early not only saves you money but also allows you to regain possession of your vehicle sooner!

Question: Are cars and motorcycles all you pawn?

Answer: Not at all, E-Pawn specialises in pawn shop loans on high-value goods, so we consider pawning a wide range of items beyond cars and motorcycles. We also accept trailers, boats, trucks, jet skis, caravans, heavy machinery, and even aircraft. Essentially, E-Pawn deals with virtually anything that holds substantial value, providing customers with more options to access fast cash loans using their valuable assets as collateral.