About E-Pawn | Trusted Car Pawn Shop in Parramatta

E-Pawn: Sydney’s Best Place to Pawn a Car or Motorcycle for Instant Cash!

We also pawn other high-value items like Jet Skis & ATVs

• Shop 6c/3 Victoria Rd, Parramatta •

Find us on Google Maps📍

✔️ Cash Loans to $50,000

✔️ No credit checks

✔️ No Application Fees

✔️ 1 to 90 Day Loans

We Pawn all Quality Cars

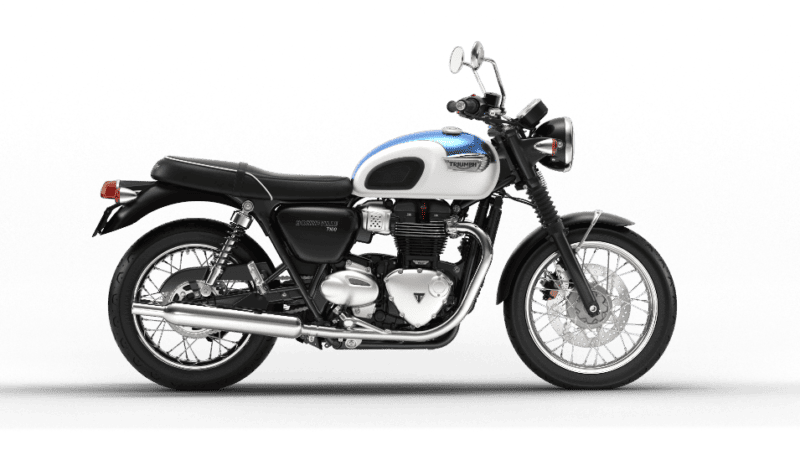

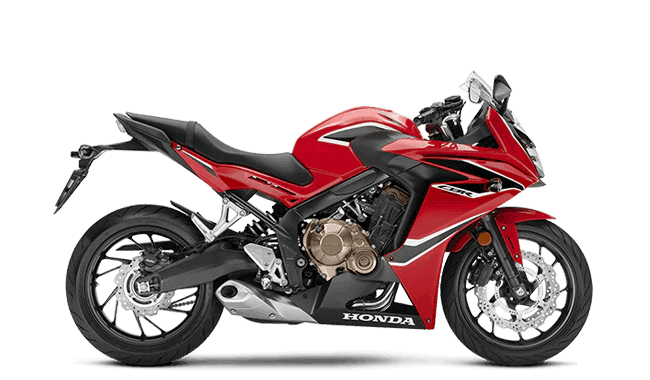

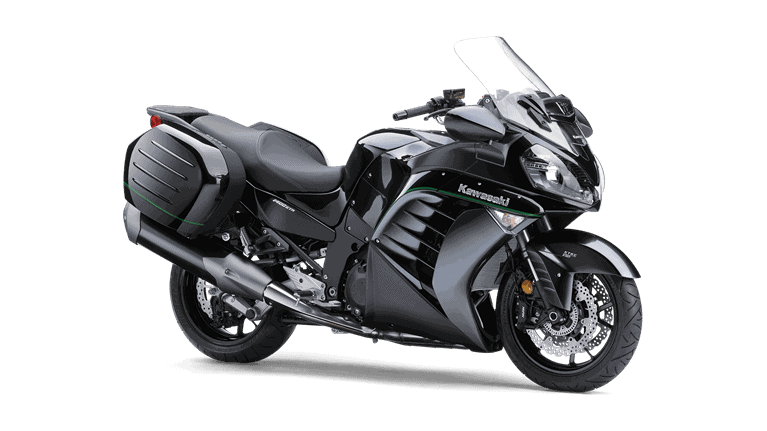

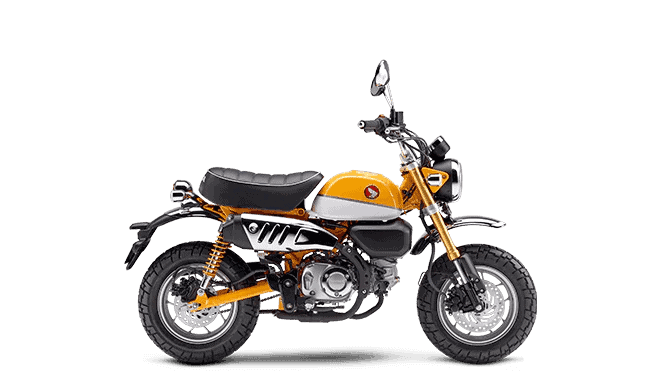

We Pawn most Motorcycles

Want to know more about our Pawn Loans – Call us today!

Or use our Online Enquiry Form and we’ll call you

Or ‘Text’ pics of your car or motorcycle for a free loan-value appraisal. Click here to see how >>

Fastest Cash Loans in Sydney – Pawn a Car or Motorcycle Today with E-Pawn

1 Hour – That’s all it takes!

Our pawn shop for cars and motorcycles offers 1-hour cash loans ranging from $2,000 to $50,000 – possibly more, just ask! Enjoy same-day cash settlement on all loans.

Borrow money for any purpose: from car repairs and essential bills to medical treatment and supporting loved ones. It’s fast, easy, and convenient.

Get a free no obligation quote >>

If you’re looking to pawn a car or motorcycle to raise cash quickly, come to E-Pawn. Our experienced team offers competitive rates and same-day loans to meet your needs.

Looking for a pawn shop in Parramatta with our famous 1-hour service? Find us at Shop 6c, No.3 Victoria Road, Parramatta, NSW, 2150. Check us out on Google Maps 📍

Fastest Cash in the West !! $$

E-Pawn is one of Sydney’s leading auto pawn shops, specialising in fast and easy cash loans secured against your car, motorcycle, Jetski, or ATV. We offer competitive rates and reasonably flexible loan terms to suit most customers’ needs, ensuring a straightforward and convenient process for quick cash when you need it most.

If you’re looking to pawn a car or borrow cash quickly, you’ve come to the best car pawn shop in Sydney. Our car pawnbroker and money lending service offers the fastest way to secure a short-term cash loan. Whether you have good or bad credit, our secured title loans against your car or motorcycle eliminate the need for credit checks.

Whatever the type, make, or model, we aim to pawn cars and motorcycles quickly — usually within the hour. E-Pawn Pawnbrokers is proud to be Sydney’s trusted pawn shop for cars and motorcycles.

Conveniently located in Parramatta, we’re here to provide hassle-free loans when you need them most.

Money Lent Instantly

Want to know more about our Car Pawn loans … Give us a call today!

Or use on our quick application form below and we’ll contact you with a quote

Quick Application Form

Frequently Asked Questions

Pawn a Car ++ Pawn a Motorcycle ++

Question: Why is pawning a car for cash the easiest way to get a fast cash loan?

Answer: When you pawn a car for cash is the easiest way to get a fast cash loan because it requires minimal paperwork and no credit checks. Unlike traditional bank loans, which involve lengthy approval processes, pawnshops offer immediate cash in exchange for your car as collateral. As long as you own a car and can provide proper identification, you can quickly access the funds you need without the hassle of extensive background checks or credit evaluations. However, it’s essential to consider the risks involved, as failure to repay the loan may result in the loss of your car.

Learn more about how to hock a car >>

Question: Is it better to pawn my motorcycle for a fast cash loan than to sell it?

Answer: The decision to pawn a your motorcycle for a fast cash loan, or sell it, depends on your specific financial needs and priorities. Pawning your motorcycle allows you to retain ownership while accessing immediate cash, using the bike as collateral. This option is ideal if you plan to repay the loan and retrieve your motorcycle. However, if you are uncertain about your ability to repay the loan or no longer need the motorcycle, selling it outright may be a better choice. Selling the motorcycle provides a lump sum of cash without the obligation of repayment. Consider your financial circumstances and long-term plans to determine which option aligns better with your needs.

Learn more about how to hock a motorcycle >>

Question: Are pawn shop loans faster than traditional finance?

Answer: Pawn shop loans differ from traditional finance companies in their accessibility and speed. Unlike traditional lenders that often require extensive credit checks and documentation, pawn shops, such as E-Pawn, provide quick cash based on the collateral value of items like cars and motorcycles without the need for credit history. This makes pawn shop loans secured against cars and motorcycles more accessible to individuals with varying credit backgrounds. Additionally, the approval process is expedited, enabling borrowers to receive cash swiftly. While traditional finance companies may offer larger loan amounts, pawn shop loans offer a more streamlined, flexible, and accessible solution for those in need of immediate financial assistance without the bureaucratic hurdles often associated with conventional lending institutions. This why our Pawn shop for Cars is a better option when you need cash fast.

Learn more about other things we pawn >>

Can I Get a Discount if I Repay My Car Pawn Loan Early?

Answer: Yes, we offer a discount for early repayment of your car pawn loan! If you repay (redeem) your loan within the first 10 days of pawning your vehicle, you’ll receive a 10% discount on the interest owed. It’s our way of rewarding borrowers who settle their loans quickly. Keep in mind, interest is calculated at a flat rate for the first month, then transitions to a daily rate for the remainder of the loan term. This term typically lasts up to a maximum of 90 days. Paying off early not only saves you money but also allows you to regain possession of your vehicle sooner!

Question: Are cars and motorcycles all you pawn?

Answer: Not at all, E-Pawn specialises in pawn shop loans on high-value goods, so we consider pawning a wide range of items beyond cars and motorcycles. We also accept trailers, boats, trucks, jet skis, caravans, heavy machinery, and even aircraft. Essentially, E-Pawn deals with virtually anything that holds substantial value, providing customers with more options to access fast cash loans using their valuable assets as collateral.